Steve at Wealth on Track was extremely helpful in getting me an affordable and competitive home loan. They took away all the stress with their easy-to-use website, constant updates and friendly customer service. I honestly don’t think I would have been able to find anywhere near as good a deal if I was searching on my own so I can’t recommend Wealth on Track enough for anyone in need of a home loan. Thomas W.

Steve was excellent! Always took the time to explain things to me that I didn’t understand and made the process of buying a home a lot less stressful. Michael M

My Mortgage

Get the Right Home Loan for you with our Mortgage Solutions

As a client of Wealth on Track you have access to our exclusive Mortgage Solutions offering:

- Assessment of your loan to determine if it is right for your needs

- Assistance with strategies to own your home faster

- Market leading lending products and providers through our panel of lenders

- Lending and credit advice to support your Financial Adviser’s strategy

- An easy to access point of contact for you during the loan application process

Bust my mortgage via debt recycling

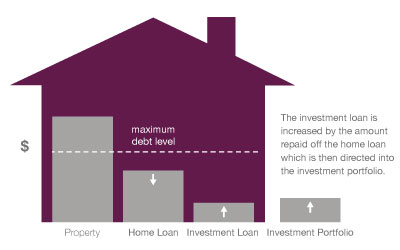

As you pay down your home loan, you may want to progressively redraw the equity you create for investment purposes

Debt Recycling

There are many strategies that we have for managing your debt. Debt strategy is probably the thing we see clients doing poorly most often.

There are many debt strategies that we use but one of the most exciting is Debt Recycling.

Two concepts should be understood first:

Efficient Debt: This means you get a tax deduction on the debt

Inefficient Debt: No tax deduction on this debt (generally your personal debt – home loan, car loans, personal loans and credit card debt)

How does the strategy work?

While it’s important to reduce inefficient home loan debt as quickly as possible, it’s also important to build wealth for the long term to meet your lifestyle goals.

However, many people wait until their home loan is paid off before thinking about investing. Unfortunately, this means they invest later in life, and don’t give their investments time to grow.

With debt recycling, you need to:

- Use the equity in your home to establish an investment loan (such as a line of credit),

- Invest the borrowed money in assets such as a diversified share portfolio

- Use the investment income and tax advantages arising from the geared investment, as well as your surplus cashflow, to reduce your outstanding home loan balance

At the end of each year, you can borrow an amount equivalent to what you’ve paid off your home loan and use the money to purchase additional investments.

The process is then continued each year until your home loan is repaid. After that, your surplus income (including investment income and tax advantages) can be used to acquire additional investments or pay down your investment loan.

To find out if a strategy like this will help you, please book a meeting.

Wealth On Track Pty Ltd (Corporate Credit Representative no.377373) and Stephen Greatrex (Credit Representative No. 369778) are Authorised Credit Representatives of Centrepoint Alliance Lending Pty Ltd ABN 40 100 947 804 (Australian Credit Licence 377711).

2 Comments on “My Mortgage”

Please call me on 0412 874 450

Hello

I am wondering if you can help my wife and I with my home loan. I purchased my house back in December 2014 through Mortgage house which at the time I purchased the property for $285000. Mortgage house set it up so it’s covered by 2 loans The main one is through Pepper and the other maybe an internal loan. The Pepper loan was taken at 90% LVR $256000 (approx) while the other loan covered the mortgage insurance and other fees including a risk fee. This brought the combined amount borrowed against the house up to $350000 (approx). The Pepper loan is now down to $248000 while the other loan is still around <$90000 (approx). I have done some considerable amount of work to the house to try and gain in property value. I have installed a pool and modernised the inside of the house plus it is also located on a big 1120sqm block of land.

I am really after trying to combine the 2 loans together and make it so I am paying a much cheaper rate. The Pepper loan is at 5.05% and the other loan is at 10%(interest only). I sure hope there is something you can do about this?

Steve